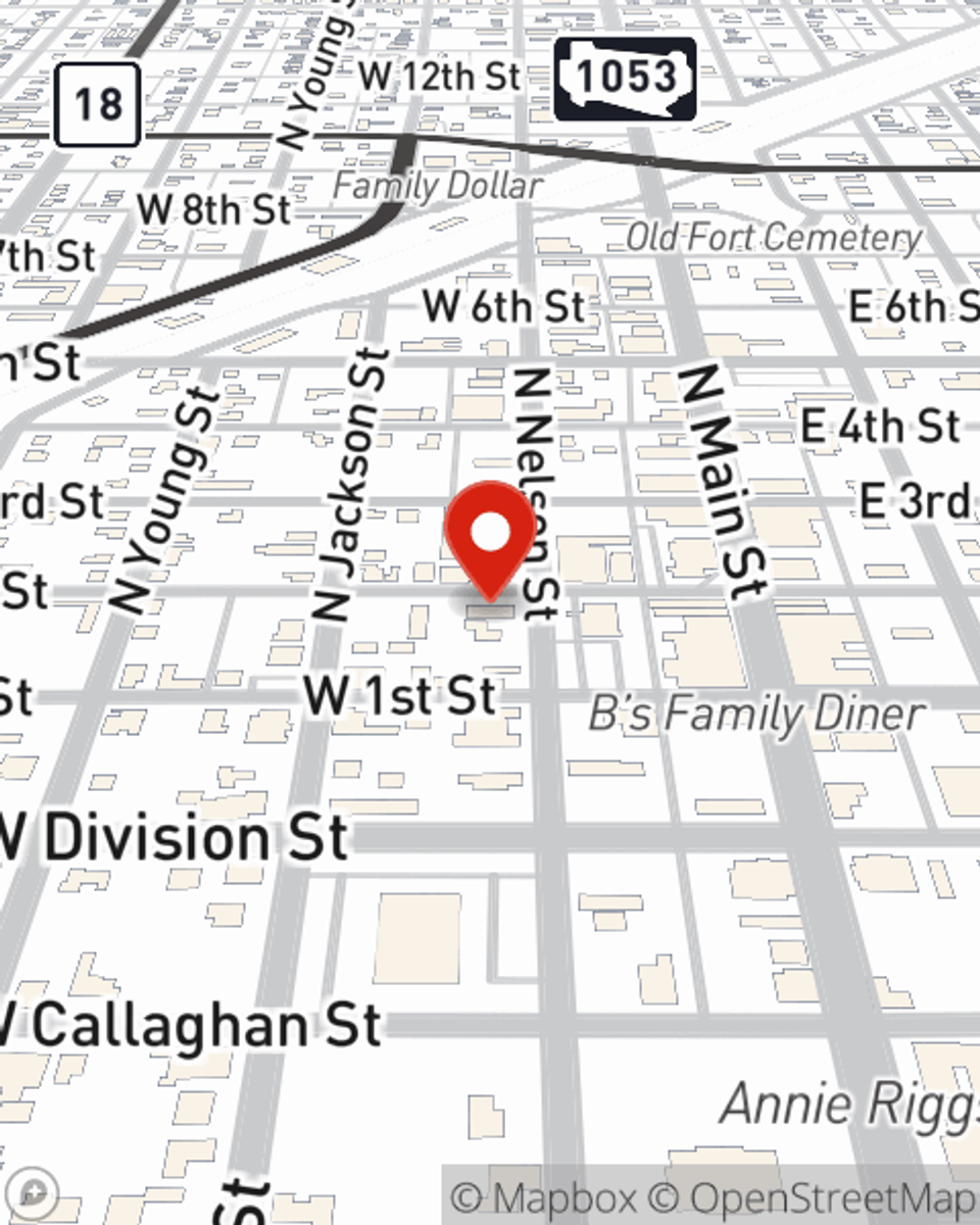

Homeowners Insurance in and around Fort Stockton

Looking for homeowners insurance in Fort Stockton?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

Your home is a special place. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, an industry leader in homeowners insurance. State Farm Agent Kessia Ledesma is your dependable authority who can offer an insurance policy personalized for your precise needs.

Looking for homeowners insurance in Fort Stockton?

Apply for homeowners insurance with State Farm

State Farm Can Cover Your Home, Too

From your home to your prized collectibles, State Farm has insurance coverage that will keep your valuables secure. Kessia Ledesma would love to help you feel right at home with your coverage options.

Don’t let fears about your home make you unsettled! Get in touch with State Farm Agent Kessia Ledesma today and learn more about the advantages of State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Kessia at (432) 336-8575 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to keep birds away from your house

How to keep birds away from your house

If birds or geese are a problem in your yard, becoming a nuisance to you and your family, these deterrent tips may help you keep unfriendly fowl at bay.

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.

Kessia Ledesma

State Farm® Insurance AgentSimple Insights®

How to keep birds away from your house

How to keep birds away from your house

If birds or geese are a problem in your yard, becoming a nuisance to you and your family, these deterrent tips may help you keep unfriendly fowl at bay.

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.