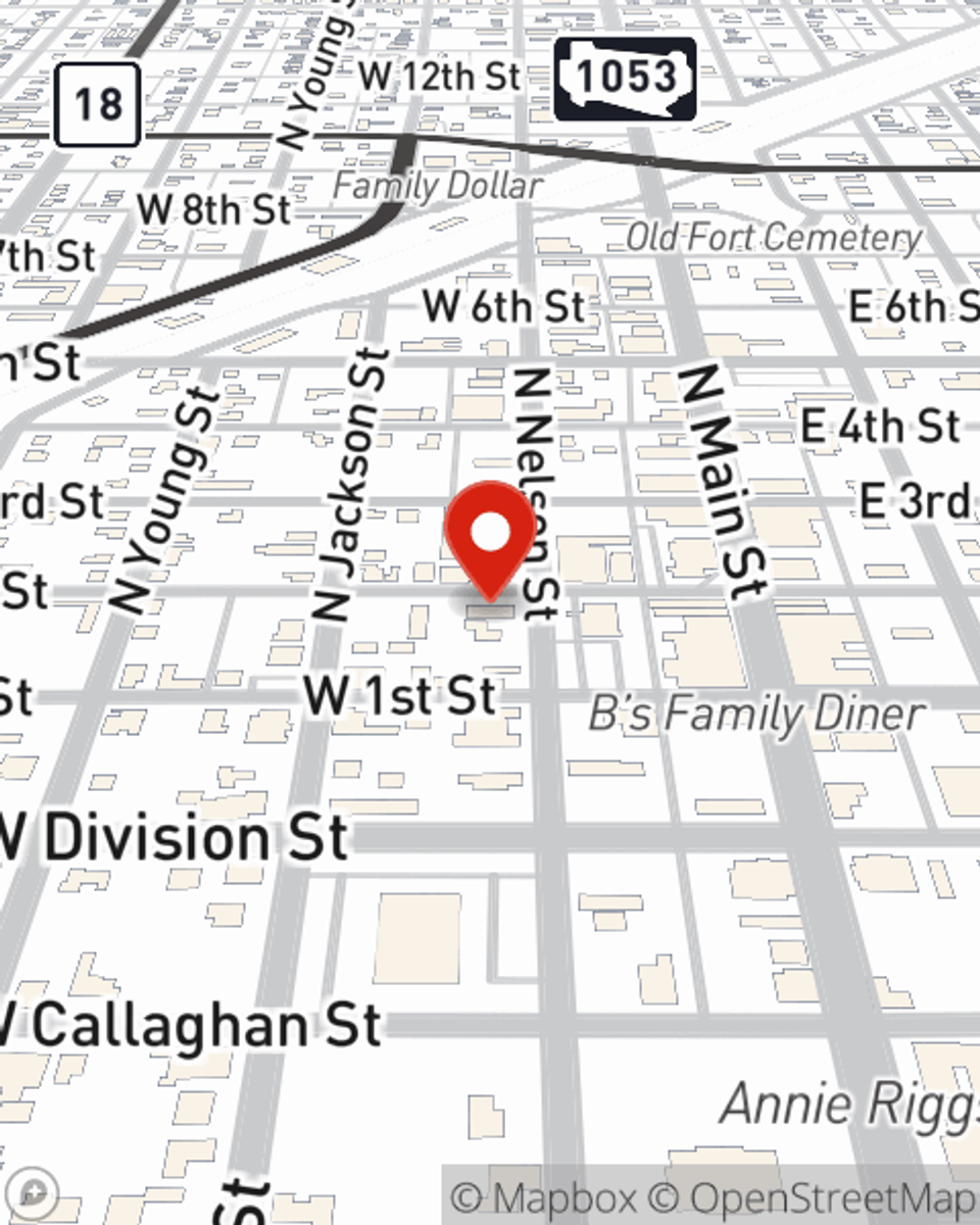

Business Insurance in and around Fort Stockton

One of the top small business insurance companies in Fort Stockton, and beyond.

No funny business here

Cost Effective Insurance For Your Business.

When you're a business owner, there's so much to consider. It's understandable. State Farm agent Kessia Ledesma is a business owner, too. Let Kessia Ledesma help you make sure that your business is properly covered. You won't regret it!

One of the top small business insurance companies in Fort Stockton, and beyond.

No funny business here

Surprisingly Great Insurance

If you're looking for a business policy that can help cover equipment breakdown, extra expense, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

Contact the exceptional team at agent Kessia Ledesma's office to learn more about the options that may be right for you and your small business.

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Kessia Ledesma

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.